6 Essential Steps to Take Your Business to the Next Level

It probably goes without saying that cash is king and, in my experience, most small business owners rightly take the health of their bank balance as the main indicator of performance. This focus on cashflow is a great starting point, but if you’re looking to take your business to the next level cash awareness alone won’t be enough. So in this article, we will explore additional areas that you can add to your radar to enhance how you manage your business.

First and foremost, it’s essential to note that no matter what size your business is or how well it is performing, monitoring your cashflow is always a good idea. Cashflow is the lifeblood of any business and serves as a foundation for growth.

However, it is profitability that sustains the business in the long-term and ensuring that you have up-to-date regular profit figures is crucial to ensuring your business is on track. If you outsource your bookkeeping or accounting, you will need to request management accounts at least quarterly to stay on top. Lengthier time frames give you far less opportunity to course-correct if you find things are not going to plan.

Improved profitability is the indisputable measure of strong performance, whereas an improvement in cashflow could mean anything from better debt collection, slower creditor payments (or non-payment!), reduced stock etc. On the other hand, a short-term reduction in cashflow as part of a growth plan is not a reason to panic and is part and parcel of funding increased stockholding or credit sales to fuel that growth. The trick is to have a plan so you know when to expect the cash account to return to normal. So do you have some kind of cash forecasting system in place to help you with this?

Operational Efficiency drives profitability and allows you to grow further. While it is nice to look at the cash account growing, is this really the best use of the business’s resources? Even if you don’t want to look at deposit options, perhaps there are early payment discounts with vendors you could take advantage of, for example. Leaving excess cash sitting in the bank account for longer periods, is the same as leaving a machine standing idle. Tighter reins could encourage your business to optimise the cash cycle, ensuring stocks are kept to what is needed, customers are paying to terms and supplier credit terms are maximised. Of course, you don’t want to let the cash burn a hole in your pocket, tempting you to buy some nice shiny piece of kit without having a plan as to how that equipment will help deliver your goals.

If your bank balance is good, maybe it could be even better if you put a little attention on some other areas. Here are six steps to get you there to help you up your game in measuring the success of your business.

Step 1: Have a plan for your business.

This doesn’t have to be an intimidating nest of spreadsheets. You probably have some end goal in mind, so just step it back from there in terms of sales year-by-year and month-by-month. If you can estimate your sales targets, it is easy to forecast your cash and create a plan from that.

Step 2: Develop a budget to deliver your plan.

The best starting place is to use your current expense spending as a starting point. Once you know your costs for one level of sales, it is not a big jump to scale up an estimate.

Step 3: Decide on what you will measure.

Accountants will advise on standard KPIs (Key Performance Indicators) but if these aren’t how you think of your business, don’t be afraid to use what speaks to you. The best advice is to set measurements that are “SMART” (specific, measurable, achievable, relevant and time-bound), a reminder of the most important factors to capture in any metric you choose. So for example, if your goal is around sales growth, you might have a goal of X number of new customers each month or X number of sales calls.

I would advise picking a few simple yardsticks to focus on at first because having too many to review makes it more difficult to see the wood for the trees.

Step 4: Build a routine around your chosen metrics.

You want to see these measurements regularly – not just when you think things are going well or badly. They need to be woven into how you manage your business. Ask your accountant or admin staff to produce them for you on an agreed regular basis, for example monthly or quarterly.

Step 5: Know your Cash Cycle.

To help maintain your focus on cashflow, it is a good idea to set one of your measurements around your cash cycle.

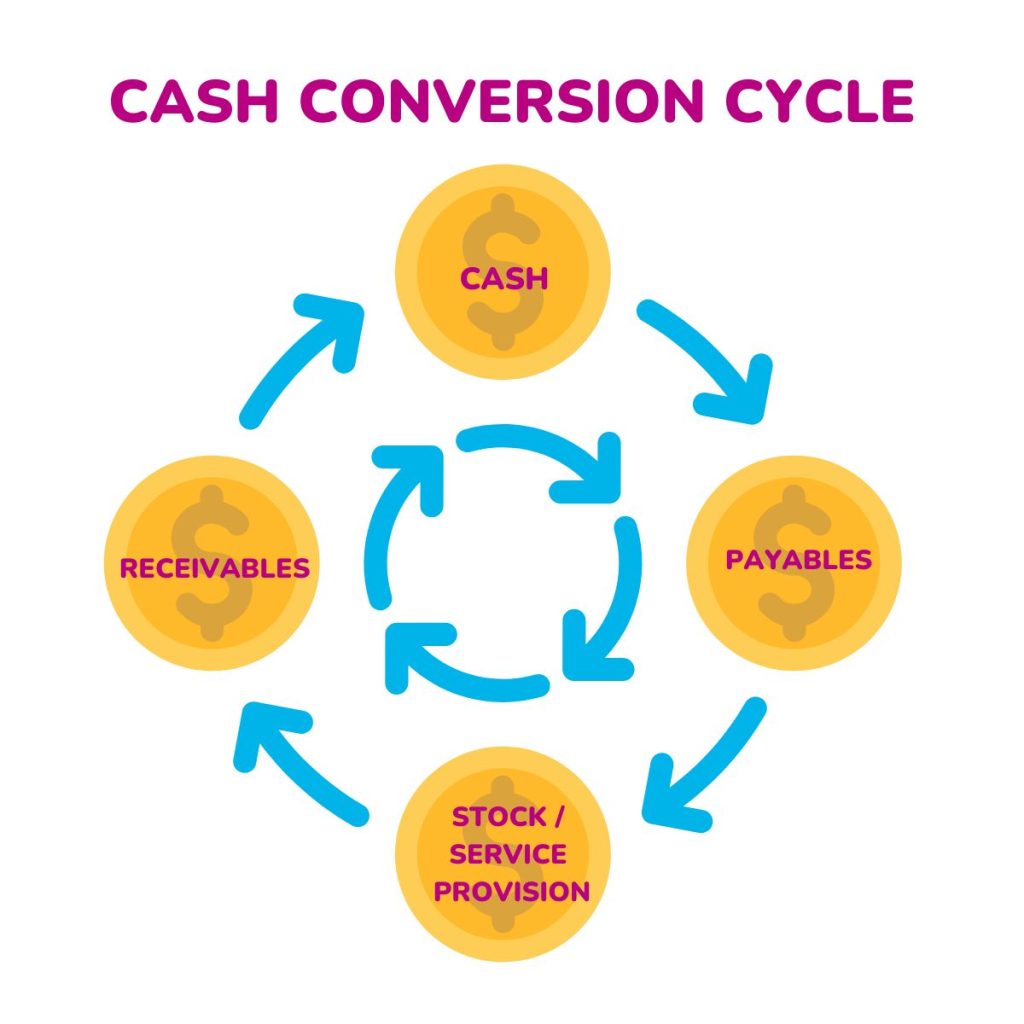

The Cash (Conversion) Cycle measures how well a business uses its working capital. Traditionally it looks at inventory, receivables and payables in product-based business. However, in a service company, reducing expenses through operational efficiency and sales conversion measurements become an important focus. There are actual formulas you can use to calculate this but if you prefer to think of the components individually, that works fine too.

Find the point(s) that you think could be improved. For example, perhaps you are in business a while now and might be able to push for better credit terms from your suppliers or maybe you want to focus on improving stock turnover.

Step 6: Don’t forget your bank balance.

As your business grows and becomes more complex, set up notifications and reminders to help you keep an eye on the fundamentals.

Bringing your attention beyond your cashflow to other aspects of your business’s performance, you can help drive it towards your longer-term goals. Cashflow remains a vital aspect, but expanding your perspective to encompass other critical areas will enable you to unlock the full potential of your business success.